Written by Jack Wong

Table of Contents

Introduction

Sunrun vs Vivint Solar (Pre-merger)

Why did Sunrun acquire Vivint Solar

Was the 5 billion acquisition worth it?

Why did the acquisition turn out to be ineffective?

As an investor in the Solar industry what does this mean?

Introduction

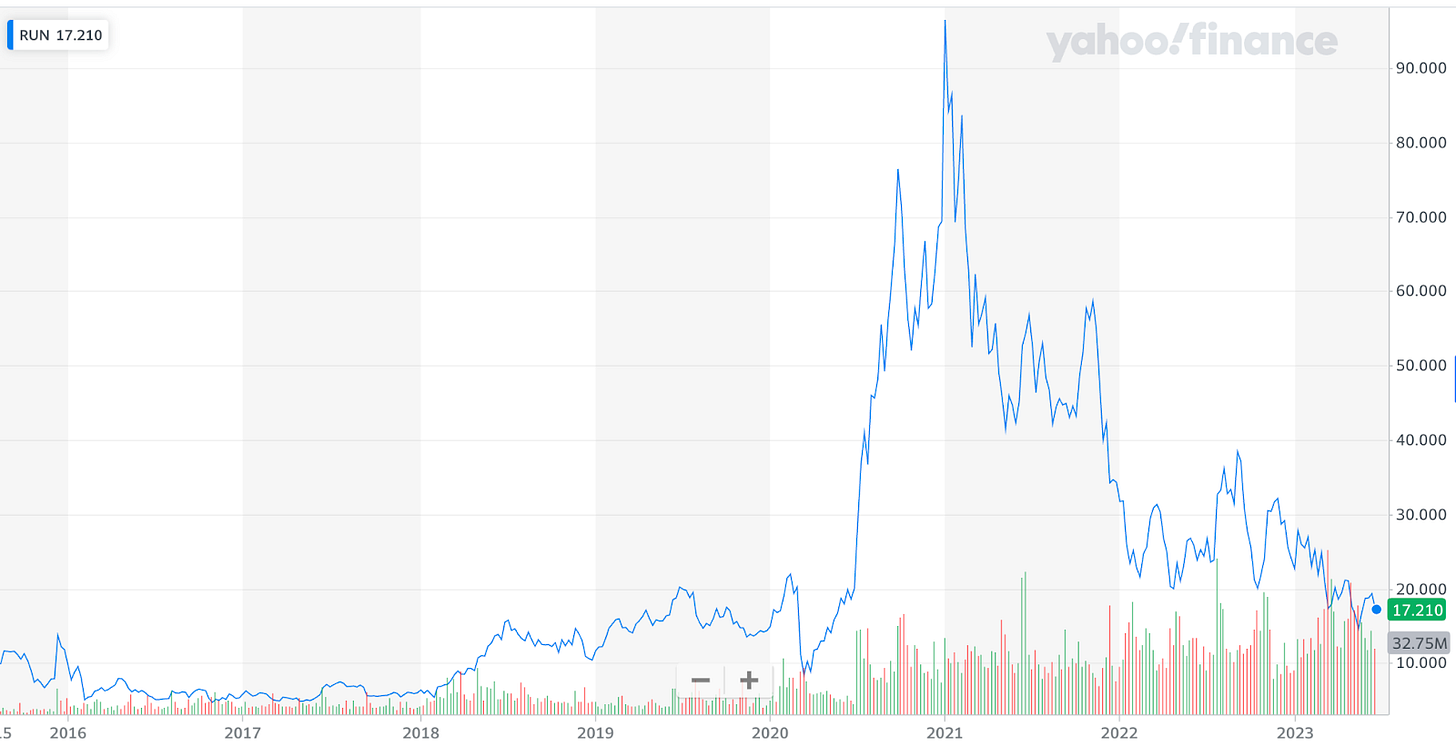

Above shows Sunrun stock price. Sourced from Yahoo Finance

It has been approximately 7,563 days since Sunrun made headlines with its acquisition of Vivint Solar in a groundbreaking $5 billion deal, which sent shockwaves through the solar panel industry. However, this tale is far from resembling a Cinderella story. Since the announcement of the acquisition on October 8, 2020, Sunrun's stock price has plummeted by an alarming 75%. This unfortunate turn of events serves as a stark reminder of the cutthroat nature of emerging industries, such as the solar industry. Despite the promising potential that the acquisition held for Sunrun, it serves as a cautionary tale, shedding light on the fierce competition and challenges faced by companies operating in rapidly evolving sectors.

Sunrun vs Vivint Solar

Overview

Sunrun is a prominent player in the solar panel industry, with a primary focus on delivering comprehensive solar energy solutions to residential consumers. Their offerings encompass a range of products, including solar panels, battery storage systems, inverters, and monitoring systems. However, what sets Sunrun apart and has contributed to their reputation is their innovative lease and power purchase agreement models, which provide customers with more affordable pricing options for accessing solar energy. As of the end of 2019, Sunrun boasted an impressive aggregate total of 1900 megawatts of solar panel capacity and reported gross earnings assets amounting to approximately 3.7 billion dollars.

Vivint Solar, another key player in the residential solar panel industry, shares similarities with Sunrun in terms of providing solar energy solutions to residential customers. Like Sunrun, Vivint Solar also offers power purchase agreements, leases, and outright sales options. However, they differentiate themselves by employing a direct-to-home sales approach. This strategy involves a dedicated sales team actively engaging with potential customers by visiting homes in specific neighborhoods. By cultivating a geographically concentrated customer base, Vivint Solar aims to reduce costs and enhance operational efficiency. Notably, Vivint Solar had an aggregate total of 1200 megawatts of solar panel capacity.

It's important to highlight a shared characteristic between Sunrun and Vivint Solar: both companies do not possess internal manufacturing capabilities. Instead, they rely on external manufacturers and suppliers for sourcing all the necessary components and equipment for their solar energy systems. (Remember this)

In summary, Sunrun and Vivint Solar were direct competitors in the solar industry, and the potential merger between them presented a compelling opportunity for Sunrun to create significant shareholder value. Despite the subsequent challenges faced by Sunrun post-acquisition, the initial prospect of combining these two industry leaders showcased the potential for market consolidation and growth in the solar energy sector.

Financial Performance (Pre merger - 2019)

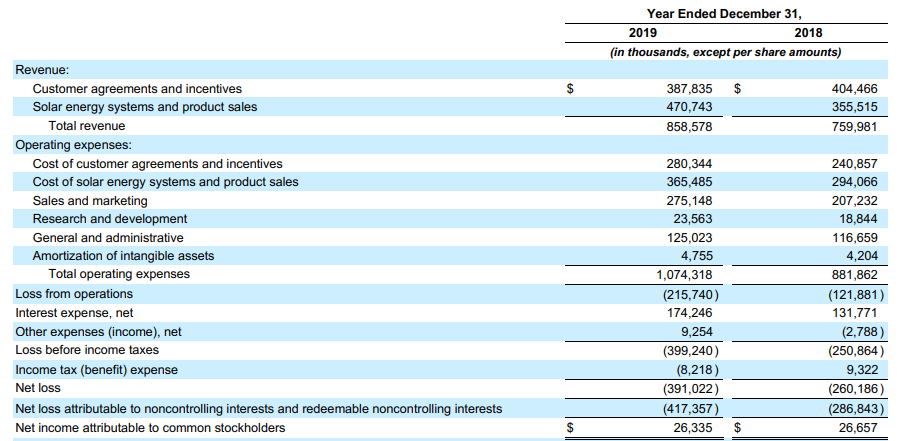

Above shows Sunrun income statement, Sourced from 2019 10k

Sunrun's growth trajectory is accompanied by operational challenges, particularly in managing its operating costs. While the company has seen increasing revenues, its operating costs have grown at a higher rate, with its sales and marketing expense nearly on par with the cost of acquiring solar energy systems.

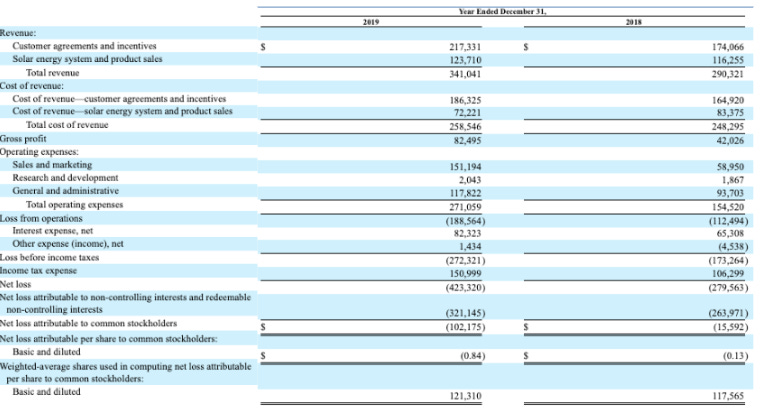

Above shows Vivint Solar income statement, Sourced from 2019 10k

Both Sunrun and Vivint Solar faced profitability challenges, primarily attributed to their cost of goods sold (COGS) and high sales and marketing expenses. Both companies encountered difficulties in generating profits as the costs associated with acquiring customers and acquiring solar energy systems outweighed the incoming revenue.

In the case of customer acquisition, the solar industry's high customer acquisition costs posed a significant hurdle for both Sunrun and Vivint. The expenses incurred in attracting and onboarding customers were substantial, impacting their overall profitability. Additionally, the cost of acquiring solar energy systems, such as solar panels, proved to be another major cost driver for both companies. The volatility and expenses associated with procuring these systems contributed to their struggle in achieving profitability.

Why did Sunrun acquire Vivint Solar

The acquisition between Sunrun and Vivint Solar held several strategic advantages for Sunrun. Firstly, the merger was expected to generate significant cost savings of $90 million annually (as stated in the 2020 10-K report). This cost reduction primarily stemmed from Vivint's direct-to-home sales channel, which supposedly would create a more efficient sales process compared to its own. By integrating Vivint's sales process into their own operations, Sunrun aimed to improve sales efficiency and enhance profitability, an area where Sunrun had previously struggled. Also the streamlined sales channel would supposedly be more effective in acquiring new customers, thereby boosting sales.

Secondly, the acquisition would contribute to Sunrun's growth by adding approximately 210,000 customers and 1,441 megawatts to their existing fleet (as stated in the 2020 10-K report). At the time, Sunrun had around 300,000 customers and 1,987 megawatts, so the acquisition would solidify their position as the market leader in the residential solar sector, with over 500,000 customers and more than 3,000 megawatts of aggregate capacity. This customer acquisition strategy was particularly crucial considering the low market penetration rate of only 3% in the residential home market. Acquiring a significant number of customers was imperative in the race to establish market dominance. Additionally, the acquired customers would provide a steady revenue stream for Sunrun, as customer agreements were Vivint's primary source of revenue, accounting for almost two-thirds of their total revenue.

Lastly, the acquisition would grant Sunrun improved access to project finance and other capital at lower costs and better terms (according to the 2020 10-K report). Sunrun received $433.2 million in cash, bringing its cash balance to $520 million. Furthermore, they obtained nearly $1.8 billion in debt from Vivint Solar, comprising a mix of credit facilities and loans. This influx of capital was a significant objective for Sunrun, as Vivint Solar had a history of securing large credit and loan facilities. The enhanced access to capital would provide Sunrun with the financial resources needed to support their growth plans and investment in expanding their solar energy operations.

Although not explicitly stated by Sunrun, it can be inferred that the removal of a direct competitor would reduce pricing pressures and potentially enable Sunrun to maintain higher prices. This would be particularly advantageous in a price-sensitive market like the solar industry, where competition is fierce.

Was the 5 billion acquisition worth it?

After the $5 billion acquisition of Vivint Solar, Sunrun's valuation soared to nearly $9 billion, factoring in estimated synergies (goodwill) worth $4 billion. However, three years later, the true valuation and whether they overpaid remains uncertain. Delving into the financial perspective alone, the answer remains elusive as revenues grew but costs grew equally. This raises intriguing questions about the factors contributing to the valuation and potential overpayment.

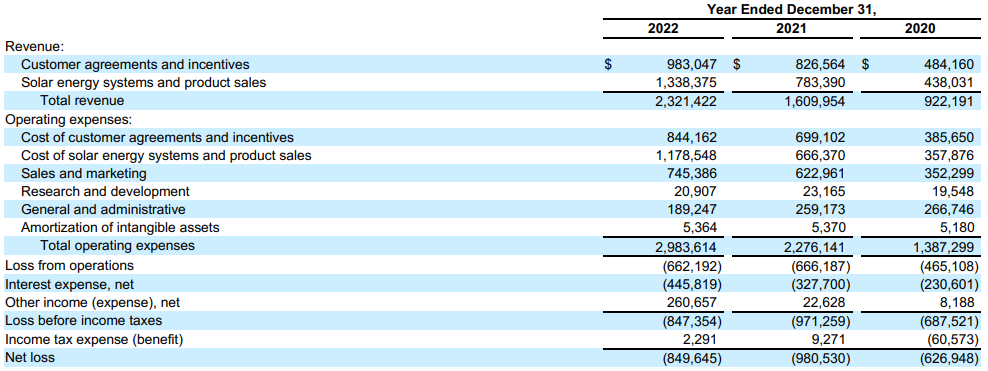

Sourced from Yahoo finance

The financial and operational synergies anticipated from the acquisition did not fully materialize as expected. While the acquisition was intended to generate significant cost savings of $90 million and improve operational efficiency, the actual savings achieved were limited. The Sales & Marketing expense to Total revenue ratio remained stagnant at around 32% both pre-merger (2019) and approximately two years post-merger. This high expense ratio indicates that the anticipated cost savings were not realized, suggesting that the merger may not have been as successful in improving operational efficiency as initially envisioned. Although it is possible that the integration process is still early and ongoing, the lack of progress suggests the acquisition being a failure.

However, the acquisition did yield some positive results in terms of capital utilization and revenue generation. Sunrun's revenue experienced a remarkable growth of nearly 250% between 2020 and 2022. Furthermore, the solar energy capacity expanded to 5,667 megawatts, serving approximately 800,000 customers. These outcomes indicate some level of operational synergy that contributed to revenue growth, regardless of the amount of capital invested to achieve it.

Why did the acquisition turn out ot be ineffective?

Despite the acquisition's effectiveness in certain areas, it failed to provide value in an aspect that would become increasingly important for Sunrun—namely, the cost of revenue. Both Sunrun and Vivint Solar relied on third-party manufacturers and suppliers for their solar panels and other products, meaning the acquisition did not bring about any additional value or efficiency in reducing this cost. In fact, the cost of goods sold (COGS) for solar energy systems as a percentage of revenue showed an upward trend. In 2020, the COGS/revenue ratio for solar energy systems was around 81%, which increased to 85% in 2021 and approximately 88% in 2022.

This rise in costs can be attributed, at least in part, to the supply disruption experienced around 2021-2022, which resulted in higher expenses for building and obtaining solar energy systems. While it is understandable that Sunrun's management could not have predicted this supply disruption, it seems questionable for them to overlook the costs associated with acquiring solar energy systems. Perhaps they believed they had limited control over these costs and focused more on gaining market share, speculating that the costs would eventually subside in the long run.

As an investor in the Solar industry what does this mean?

The concept that acquisitions yield value is extremely important, particularly in an industry characterized by perpetual evolution. However, formulating the right acquisition strategy becomes paramount in such a dynamic context. This task is further compounded by the need to not only identify an acquisition strategy but also decipher the future trajectory of the industry, which proves to be exceedingly challenging. Moreover, the solar industry presents a distinct set of problems, with a multitude of complex variables at play. Navigating this terrain necessitates a comprehensive understanding of the industry's dynamics, which of course is the hardest part.

In an emerging industry where capital constraints exist, a comprehensive approach to controlling every aspect of the operational process may not be feasible. However, given the choice between controlling the sales channel or the manufacturing channel, my prediction is that companies with control over manufacturing capabilities will be highly valued by investors. Owning and managing the manufacturing process allows companies to have greater control over the quality, cost, and supply of solar panels, offering a competitive advantage. With low market penetration, customer acquisition becomes a lesser concern, while the ability to ensure a reliable supply of high-quality solar panels becomes crucial. By prioritizing manufacturing capabilities, companies can optimize production processes and mitigate supply chain risks which will be most prominent in the upcoming years.